Workterra Can Help You Comply With the Patient Protection and Affordable Care Act (PPACA)

The constantly evolving requirements of Health Care Reform have many employers searching out industry leading technology to help with their healthcare administration process – Let Workterra be your solution!

Our proprietary software tools have been created to deliver a strategic snapshot of Health Care Reform’s impact on your business. Workterra’s Affordable Care Act (ACA) Dashboard is designed to minimize the confusion commonly associated with healthcare administration and provides a fully configurable solution to help with compliance concerns.

Our Features

Our Features

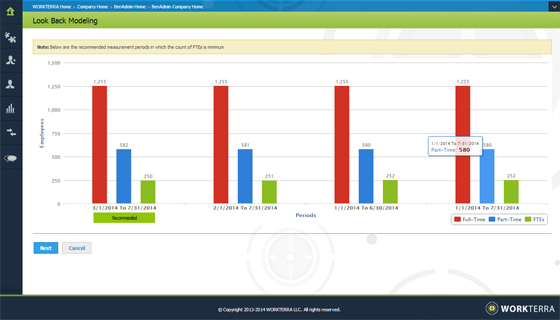

Look Back / Stability / Administrative Periods & Modeling Tools

Applicable large employers (ALEs), defined as employers with 50 or more full-time employees, are required to provide affordable health coverage meeting the minimum requirements set by the ACA. Employers may use real-time calculators or look back and stability periods to determine the amount of full-time employees (or the equivalent).

-

Set Look Back, Stability and Administrative periods

-

System automatically determines eligibility or loss of eligibility

-

Modeling tool recommends which look back period is best for the employer based on their goal

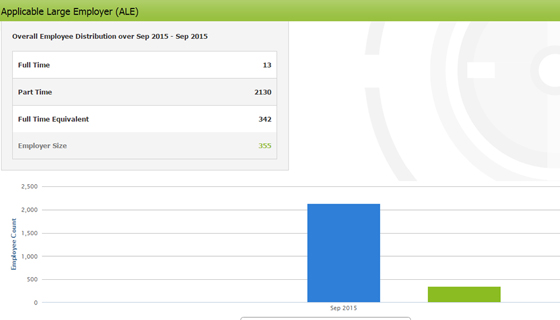

Applicable Large Employer (ALE)

An applicable large employer (ALE) is defined as an employer who has 50 or more full-time (or full-time equivalent) employees. To determine ALE status, employers are required to account for full-time and part-time employees, as well as full-time equivalents.

-

Standard Reports

-

Ad-Hoc Reporting Capabilities

-

Graphical Analytics Tools

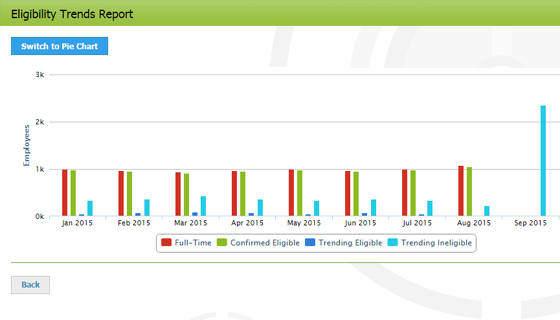

Eligibility Trends

Workterra enables employers to view different trends of an employee’s working hour pattern, including; Full-Time, Confirmed Eligible, Trending Eligible, Trending Ineligible with Low, Medium, and High Distribution.

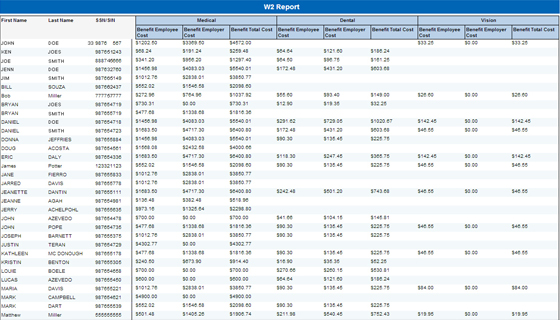

W-2 Reporting

Workterra’s advanced reporting capabilities provide employee-by-employee information on the aggregate cost of employer sponsored group health coverage. The report integrates with any payroll system to ease the burden of including this information on employee’s W-2 forms.

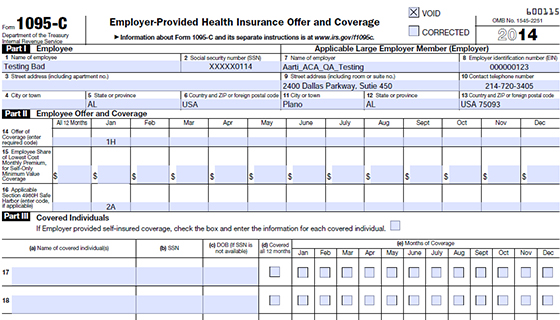

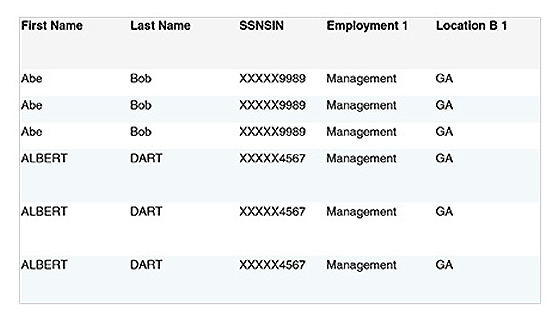

IRS 6056: Forms 1094 and 1095

Workterra’s robust reporting tools allow employers to easily generate all required information to complete IRS forms 1094 and 1095 as well as transmittal forms for submittal to the IRS.

IRS 6055

Workterra captures all of the employee-by-employee data that is required to be reported to the government. The reports show on a monthly basis whether an employee was offered coverage and whether the employee was enrolled in affordable coverage.

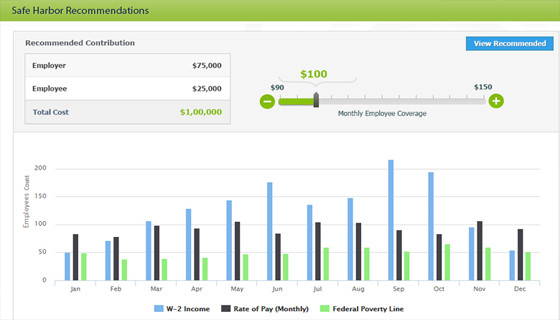

Safe Harbors

Workterra captures all of the employee-by-employee data that is required to be reported to the government. The reports show on a monthly basis whether an employee was offered coverage and whether the employee was enrolled in affordable coverage.

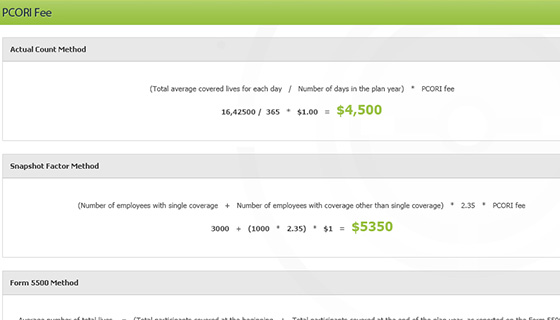

Patient-Centered Outcomes Research Institute (PCORI) Fee

Health insurance issuers and plan sponsors are responsible for paying the PCORI fee the IRS based on the number of plan participants (including employee, retirees, spouses, and dependents). The PCORI fee applied to insured and self-insured plans including those provided under COBRA. Workterra houses the data required to complete the PCORI section of IRS form 720 for self-insured health plans. Our reporting tools allow employers to determine whether the self-insured plans that they offer are affordable and calculated the average number of lives covered.